The Future of Secure Transactions: Understanding Blockchain Technology

In the modern digital age, the way we handle financial transactions is undergoing a significant transformation. Traditional database technologies have long struggled with issues of trust and security when it comes to recording financial exchanges. For instance, consider the sale of a property: once the money is exchanged, ownership of the property is transferred to the buyer. Individually, both the buyer and the seller can record the monetary transactions, but neither source can be fully trusted. The seller might claim they haven't received the money even though they have, while the buyer could argue they've paid the money even if they haven't.

To avoid potential legal issues, a trusted third party has to supervise and validate transactions. The presence of this central authority not only complicates the transaction but also creates a single point of vulnerability. If the central database was compromised, both parties could suffer.

This is where blockchain technology steps in as a revolutionary solution. By creating a decentralized, tamper-proof system to record transactions, blockchain addresses these challenges effectively. In the property transaction scenario, blockchain creates one ledger each for the buyer and the seller. All transactions must be approved by both parties and are automatically updated in both of their ledgers in real time. Any corruption in historical transactions will corrupt the entire ledger. These properties of blockchain technology have led to its use in various sectors, including the creation of digital currency like Bitcoin.

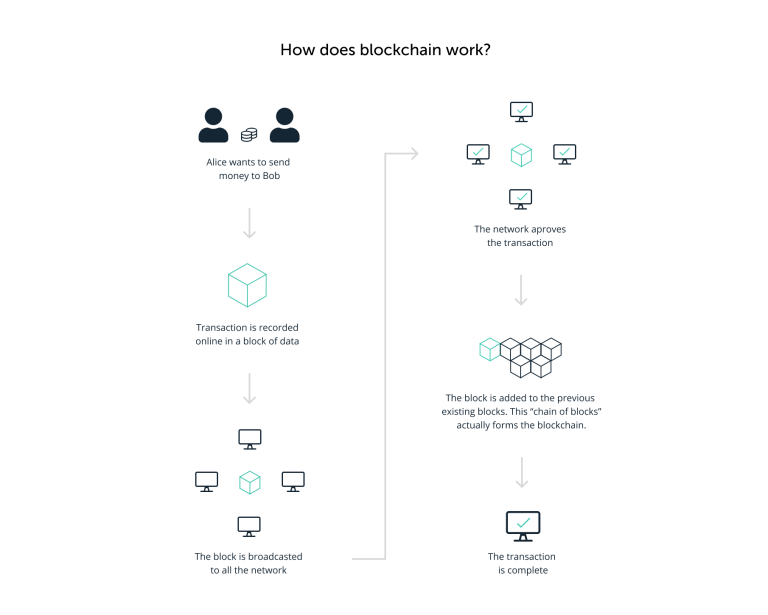

How Blockchain Works

Blockchain operates as a decentralized distributed database, with data stored across multiple computers, making it resistant to tampering. Transactions are validated through a consensus mechanism, ensuring agreement across the network. In blockchain technology, each transaction is grouped into blocks, which are then linked together, forming a secure and transparent chain. This structure guarantees data integrity and provides a tamper-proof record, making blockchain ideal for applications like cryptocurrencies and supply chain management.

The key benefit of blockchain lies in its ability to provide security, transparency, and trust without relying on traditional intermediaries, such as banks or other third parties. Its design reduces the risk of fraud and errors, making it especially valuable in industries where secure transactions are critical, including finance and healthcare. In addition, blockchain helps businesses improve efficiency and reduce costs by streamlining processes and enhancing accountability.

Key Components of Blockchain

A blockchain is a decentralized digital database or ledger that securely stores records across a network of computers in a way that is transparent, immutable, and resistant to tampering. Each "block" contains data, and the blocks are linked in a chronological "chain." This means that once data is entered into the blockchain, it becomes nearly impossible to alter without detection.

What Is a Blockchain?

A blockchain is a distributed database or ledger shared across a computer network's nodes. While it is best known for its crucial role in cryptocurrency systems, maintaining a secure and decentralized record of transactions, blockchains are not limited to cryptocurrency uses. Blockchains can be used to make data in any industry immutable, meaning it cannot be altered.

Since a block can’t be changed, the only trust needed is at the point where a user or program enters data. This reduces the need for trusted third parties, such as auditors or other humans, who add costs and can make mistakes.

The Transaction Process

Transactions follow a specific process, depending on the blockchain. For example, on Bitcoin's blockchain, if you initiate a transaction using your cryptocurrency wallet—the application that provides an interface for the blockchain—it starts a sequence of events. In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block fills up with transactions, it is closed, and the mining begins.

Every node in the network proposes its own blocks in this way because it chooses different transactions. Each works on their own blocks, trying to find a solution to the difficulty target, using the "nonce," short for number used once. The nonce value is a field in the block header that is changeable, and its value incrementally increases with every mining attempt. If the resulting hash isn't equal to or less than the target hash, a value of one is added to the nonce, a new hash is generated, and so on.

Decentralization and Transparency

A blockchain allows the data in a database to be spread out among several network nodes—computers or devices running software for the blockchain—at various locations. This creates redundancy and maintains the fidelity of the data. Because of this distribution—and the encrypted proof that work was done—the blockchain data, such as transaction history, becomes irreversible.

For example, crypto exchanges have been hacked in the past, resulting in the loss of large amounts of cryptocurrency. While the hackers may have been anonymous—except for their wallet address—the crypto they extracted is easily traceable because the wallet addresses are stored on the blockchain. Of course, the records stored in the Bitcoin blockchain (as well as most others) are encrypted. This means that only the person assigned an address can reveal their identity. As a result, blockchain users can remain anonymous while preserving transparency.

Security and Trust

Blockchain technology achieves decentralized security and trust in several ways. To begin, new blocks are always stored linearly and chronologically. That is, they are always added to the "end" of the blockchain. After a block has been added to the end of the blockchain, previous blocks cannot be altered. A change in any data changes the hash of the block it was in. Because each block contains the previous block's hash, a change in one would change the following blocks. The network would generally reject an altered block because the hashes would not match.

However, a change can be accomplished on smaller blockchain networks. Not all blockchains are 100% impenetrable. They are distributed ledgers that use code to create the security level they have become known for. If there are vulnerabilities in the coding, they can be exploited. A new and smaller chain might be susceptible to this kind of attack, but the attacker would need at least half of the computational power of the network (a 51% attack). On the Bitcoin and other larger blockchains, this is nearly impossible.

Applications Beyond Finance

Blockchain technology is not just for financial transactions. It can be used to immutably record any number of data points. The data can be transactions, votes in an election, product inventories, state identifications, deeds to homes, and much more. Currently, tens of thousands of projects are looking to implement blockchains in various ways to help society other than just recording transactions—for example, as a way to vote securely in democratic elections.

The nature of blockchain's immutability means that fraudulent voting would become far more difficult. For example, a voting system could work such that each country's citizens would be issued a single cryptocurrency or token. Each candidate could then be given a specific wallet address, and the voters would send their token or crypto to the address of whichever candidate they wish to vote for. The transparent and traceable nature of blockchain would eliminate the need for human vote counting and the ability of bad actors to tamper with physical ballots.

Conclusion

With many practical applications for the technology already being implemented and explored, blockchain is finally making a name for itself because of the demand and popularity of Bitcoin and cryptocurrency. As a buzzword on the tongue of every investor across the globe, blockchain stands to make business and government operations more accurate, efficient, secure, and cheap, with fewer intermediaries. As we head into the third decade of blockchain, it’s no longer a question of if legacy companies will catch on to the technology—it’s a question of when. Today, we see a proliferation of NFTs and the tokenization of assets. Tomorrow, we may see a combination of blockchains, tokens, and artificial intelligence all incorporated into business and consumer solutions.

Comments

Post a Comment